Best Investment Opportunity 2023: Investments in Meditation App & Health

Published on March 23, 2022 – Last Updated on March 1, 2023

There’s no doubt that the health and wellness industry is booming, and investment opportunities in this sector are only going to continue to grow in the coming years. If you’re looking for one of the best 2022 investment opportunities that have real potential to take off, then look no further than meditation apps and health-related businesses.

With millions of people around the world interested in improving their mental and physical health, there’s a lot of potential for profit in this market. So if you’re looking for a lucrative investment opportunity that also offers social good, then investing in meditation apps and health-related businesses is definitely the way to go!

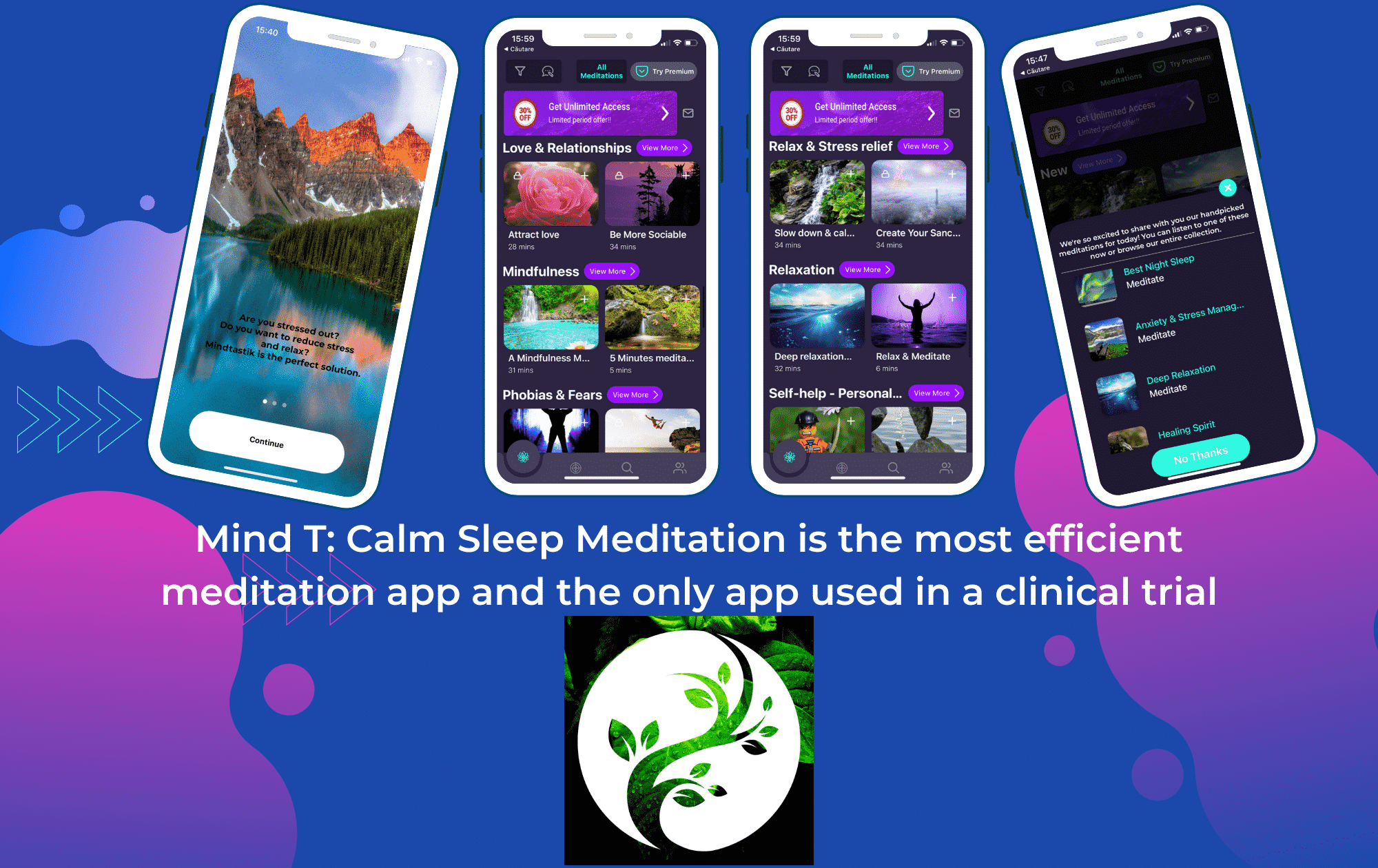

MindTastik Meditation App: One of the Best Investments 2022

MindTastik is a leading European meditation & mindfulness app backed with science and innovative 3D audio technology. With over 1M downloads, it is on an incredible growth trajectory. Our app was featured in multiple digital news and it is the only meditation app that was used in a clinical trial about procrastination.

If you’re interested in investing in a high-quality meditation app with a lot of growth potential, then MindTastik is definitely the right choice. We have a strong team of experts who are dedicated to providing our users with the best possible meditation experience, and we’re constantly working to improve our app and provide even more value to our users.

If you’re interested in investing in MindTastik, then please contact us at [email protected] for more information.

MindTastik Meditation: Our mission

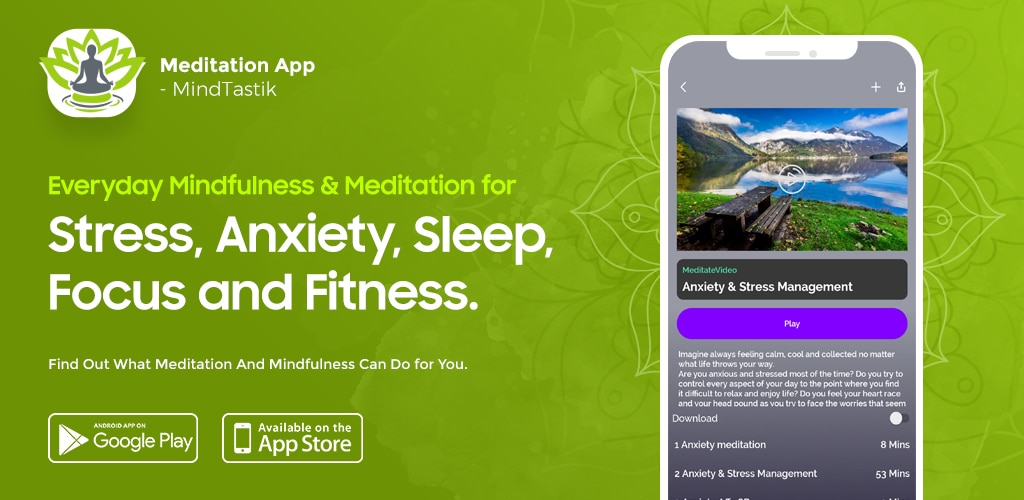

MindTastik is an app that offers users various ways to improve their mental health and wellbeing. This includes using content such as guided meditations, music tracks, or even physical products in order help them achieve the best possible mindset for success! The goal of this company isn’t just making things easier but also fighting anxiety and depression by giving people access without judgment so they can live happier lives full of confidence.

We’re working hard this year to make mental health simple and easy to understand, reduce stigma by making our solution accessible for a wide spectrum of the population. In 2022 we plan on releasing new content through our app that will help people achieve their goals in life while also improving how they feel about themselves

If you’re interested in becoming an investor and joining our mission to help people improve their mental health, then please contact us at [email protected] for more information.

Why Invest in Mind Tastik Meditation? Healthy investments for a healthier world

The health and wellness industry is booming, with no sign of slowing down. This is especially true when it comes to mental health, as more and more people are becoming interested in improving their wellbeing.

If you’re looking for a lucrative investment opportunity that also offers social good, then investing in meditation apps and health-related businesses is definitely the way to go. MindTastik is a leading meditation & mindfulness app with a lot of growth potential, and we’re dedicated to providing our users with the best possible experience.

Not only will you be making a profit, but you’ll also be helping people achieve their goals in life and improve their mental health! If you’re interested in investing in MindTastik, then please contact us at [email protected] for more information.

MindTastik is available on both iOS and Android, in more than 220 countries.

How to get priority investment access to MindTastik

Join the priority list

Express your interest in investing by providing your details.

Get early access to the campaign

We’ll notify you by email as soon as the campaign is open for priority investors.

Make your investment

You can invest before the campaign opens publicly.

Contact Us at: [email protected] for more information.

Stock Market, Growth Stocks & Investment Decisions for Calm Coin

MindTastik will launch in the second quarter a cryptocurrency token named Calm Coin. The token will be used in the MindTastik application to purchase different types of services.

The main use of the Calm Coin will be to pay for mental health services, such as therapy, coaching, and meditation.

The token will also reward content creators and pay for products that help users achieve their mental health goals.

The Calm Coin will be listed on exchanges and will have a value pegged to the US dollar.

Investors in the MindTastik app will be able to exchange their tokens for cash or hold them as an investment.

Health-Related Businesses: Another Great Investment Opportunity for 2022

Another great investment opportunity that has a lot of potentials is health-related businesses. With the rising cost of healthcare and the increasing demand for healthier lifestyles, there’s a lot of potential for growth in this industry.

There are many different types of health-related businesses that you could invest in, so it’s essential to do your research and find the right one that matches your interests and goals. Some of the most popular health-related businesses include weight loss centers, fitness centers, and health food stores.

If you’re interested in investing in a health-related business, then be sure to contact us at [email protected] for more information. I’ll be happy to help you find the perfect opportunity that fits your needs!

Here are a couple of more information about Best Investment Advice for 2022

High-yield savings accounts

Saving accounts are aimed toward preserving cash while generating income. Although inflation does not occur often, it is a great place to put away your cash for emergencies such as a bank account. Plus, there is no risk in it because the bank has a reputable account with an FDIC-insured minimum of $250,000. Unfortunately, no savings account pays nearly the 7 percent inflation rate that has been observed this year. Instead, they offer a return of 0.6% versus a nationally average return of 0.16%. Nevertheless, savings accounts may have increased returns despite the Fed’s plans to hike rates.

To get more information on this great opportunity, please get in touch with us at [email protected] for more information. I’ll be happy to help you find the perfect opportunity that fits your needs!

Dividend stocks

The dividend is cash money paid from company profits for shareholders who own stocks. This payout provides an excellent type of investment for growth and reduces the effect of inflation for 2020. Dividend stocks can help to gain cash in the short term while benefitting from long-lasting increases in shares. If you don’t have enough income, you may have invested it. However, dividend stocks are not free of risk. However, not every company that pays dividends makes a good investment, despite its reputation for its safety and stability.

If you’re interested in investing in dividend stocks, don’t hesitate to contact us for more information. We’ll be happy to help you find the perfect opportunity that fits your needs!

How Can Individual Situations Affect Your Inflation Investments?

Despite being valuable to investors, they may not always suit all investment managers. Before investing in stocks and bonds, you should consider your personal goals and risks before investing. Or instance, during average inflation, investors are usually urged to shift most of the assets into cash and fixed income. This inflation trend does not always make investors more likely to invest in stocks, commodities, or other relatively riskier investments.

What drives investment decisions during inflation is not the level of prices but how fast prices are expected to rise. Then inflation is relatively low and stable, and as it has been for much of the past decade, investors are usually more willing to take on risks in order to achieve higher returns. However, when inflation is high and/or rapidly rising, investors tend to become much more cautious and favor investments that offer stability and protection from losses.

Overview: Best investments in 2022

A good-quality online bank account pays you interest on your money. Similar savings accounts earn money in an online bank or a bank branch. A high-income savings account can be used as a way to save money. The more you spend, the higher the interest rates on a bank account. Generally, the money is accessible through quick transfers to your main bank or maybe through ATMs. Savings accounts provide borrowers with a reliable way of obtaining funds quickly.

Alternative investments and cryptocurrencies

In the investment world, the risk is often in the opposite direction. Investing in a good quality property takes more risk than you think. The risk of losing your entire investment is a significant issue for many investors. However, commodities and cryptocurrency are also very profitable, unlike traditional investment options. You can also minimize your exposure to both groups of risk and avoid compromising the safety or the quality of either of these groups.

There are two types of risks associated with traditional investment options: buying and holding risks and operating risks. In the case of buying and holding risks, the price of an asset can go down as well as up. Or example, if you buy a share in a company and the company goes bust, you may lose all your money. Operating risks are risks that are specific to the company you’re investing in, such as the risk of a management change or a natural disaster.

CryptoCurrency

Cryptocurrencies are digital currencies that use cryptography to secure their transactions and control new units’ creation. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009. Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services.

There are a few key things that you should know about investing in cryptocurrencies. Firstly, cryptocurrencies are incredibly volatile. This means that their prices can change dramatically over short periods. For example, the price of Bitcoin went from $1,000 in January 2017 to $19,000 in December 2017 before dropping back down to $6,000 in February 2018. Secondly, cryptocurrencies are not regulated by any government or financial institution. This means that you are taking on extra risks when you invest in them. Finally, you should only invest money that you are prepared to lose. This is because there is a very real possibility that you could lose all your money if the value of the cryptocurrency you invest in goes to zero.

If you want to start investing in crypto, we recommend to buy bitcoin on paybis.

Index funds

Index fund investments track various indicators for overall composition and return on investment. It’s possible to invest in indices based on the Dow Index and the Nasdaq-100 index. Some index funds specialize in a specific sector or industry, allowing additional exposure in a specific sector or industry. Index funds offer a number of advantages, including a diversified and low expense ratio and ease for individuals to obtain the funds. It can be used to purchase ETF funds or mutual funds.

ETFs or Exchange-Traded Funds are investment funds that track an index, a basket of securities, or a particular commodity. They trade on exchanges like stocks and can be bought and sold throughout the day. ETFs have become very popular in recent years since they offer investors the ability to get exposure to a number of different markets and securities in a single investment.

Mutual funds are another type of investment that can be used to purchase index funds. These are pools of money that are managed by professional investors and can be invested in several different securities. Mutual funds typically have higher fees than ETFs, but they can offer some benefits such as active management and the ability to reinvest dividends.

Why invest?

The investment process may help you earn fewer dollars or help you meet your retirement goals. Investment helps you meet your financial objectives and increases the potential of your purchase. For example, you may recently bought a property or have made an extra profit. This is an intelligent investment decision. While investing is an excellent tool to create money, you will also need to weigh risks against potential gains. You need the financial resources to make this happen, and you’ll also require managing debt levels and having a decent cash reserve to cover your emergency expenses.

When it comes to making money, there are various options from which to choose. You can save your money in the bank, purchase stocks or bonds, or invest in real estate. Each option has its own set of risks and rewards. It is vital to understand these before you decide where to put your hard-earned cash.

Saving money in the bank is often considered the safest option. Your money is FDIC insured, meaning that if the bank were to fail, you would get your money back. However, savings account interest rates are often low, and you may not earn enough to keep up with inflation.

Other exchange-traded funds (ETFs)

Exchange-traded funds are like Index funds, except they are placed on large stock markets. They package their investment in a single share that is traded on the same market as ordinary shares. In addition, some ETFs are invested into certain stocks sectors and sectors, allowing for investing specific parts of diversified stocks.

ETFs have several advantages compared to a stock market index fund, including diversifying their portfolio quickly. In addition, many ETFs have tax advantages that are better than selecting individual shares manually. Several retirement and brokerage firms offer ETF trading, giving it easy access for investors irrespective of their income level.

There are disadvantages to ETF investing. Because ETFs trade on an exchange can be more volatile than a traditional index fund. This could lead to inexperienced investors selling low and buying high. Additionally, some brokers charge commissions each time you trade an ETF, so comparing rates before selecting one is essential.

FAQ About Best Investments in 2022

What should I invest in 2022?

Best investment opportunities for 2022. Investing in a high-yielding investment bank. Short-term certificate. Short-term bond fund.

Is 2022 a good time to start investing?

Is it possible to invest five years? You can recover losses even with the stock market dropping and 2022 being off the ground.

What is the best investment for five years?

The top 5-year investment plan. Liquid fund. This is another sort of mutual fund known as a Money Market Fund, which invests the money in government bonds. Savings accounts. Postal time deposits. Mutual funds. Stocks/ Derivatives.

How should I invest my money in 2022?

Best investment for 2022: Those with a diversified income. Short-term deposited certificates. Short-run bonds. Series 1 debts. Short-term bonds. The stock markets are indexed at a 4% – 5% yearly rate. Dividend stock fund. Stocks.

What is the safest investment with the highest return?

Nine investment strategies with high profits. = = Bank accounts = = = Bond The Treasury has a programme that protects against inflation. Bond of the municipality. Corporation bonds. Stock Exchange for Investors on the NASDAQ: Comparison.

What should I invest in for 2022?

Best Investment Options 2022. Saving accounts for good returns for investors. Temporary deposits. Bond issuances. Series ii Bond. Short-term corporate bonds. Stock markets based on NYSE – 500. hares. Valuation stock fund.

What sector will boom in 2022?

India will invest around $18 billion in solar power plants and 20,000 GW of renewable electricity in the coming months.

Conclusion Best Investment in 2022

We highly recommend you invest in our product which is MindTastik Meditation App. This is a new and upcoming sector with immense potential. The company has a good management team and has developed a strong product. For more details, please get in touch with us at [email protected]